Why Easyrewardz

Enhancing customer engagement by delivering loyalty that goes beyond just transactions

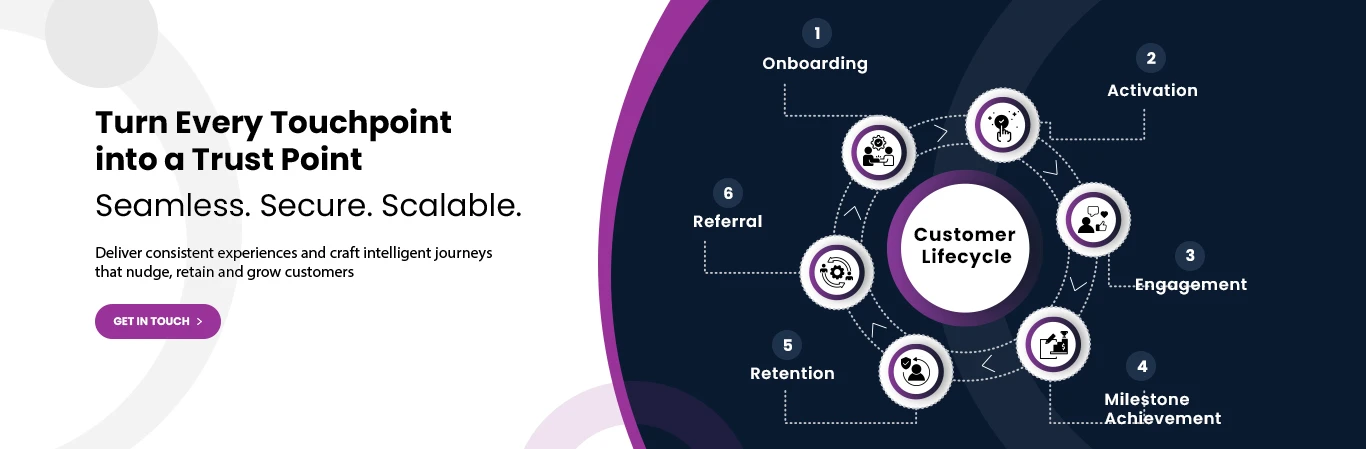

In today’s competitive landscape, customer loyalty is the cornerstone of success in the BFSI sector. Easyrewardz empowers financial institutions with a comprehensive suite of loyalty solutions designed to drive engagement, retention, and revenue growth.

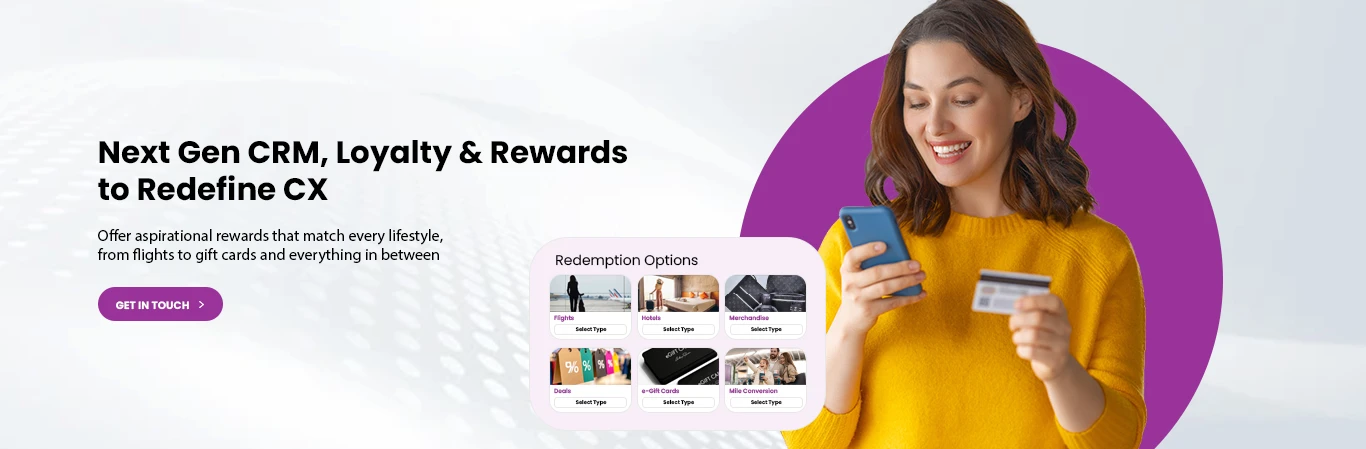

Our offerings go beyond traditional loyalty programs by integrating advanced analytics, personalized communication, and a wide range of reward options. With an in-depth understanding of the BFSI industry, our solutions exceed customer expectations and adapt to unique challenges.

Our ready-to-use platform is built for BFSI—fast to deploy, easy to scale, and flexible to integrate.